Leaving a Legacy

Legacy gifts create educational opportunities for the future.

They may not be rich and famous. That unassuming retired couple down the street. Your child’s third-grade teacher. The young entrepreneur who owns your favorite Italian restaurant.

Yet these everyday folks may be among San Diego State University’s most influential supporters, among those who have decided to turn their Aztec loyalty into a lasting legacy through planned giving.

Planning a gift

“People think that major donors and planned giving donors are the same people, but typically they’re very different,” said Erin Jones, SDSU’s senior director of planned giving.

“I think of it this way: major donors have so many chickens they can give lots of eggs away; planned giving donors need their chickens and eggs to support themselves. They can’t write a big check right now, but they have an asset base that can support a planned gift.”

Before 2000, irrevocable charitable remainder trusts were popular, Jones said. But as the market fell and asset values declined, the preference switched to bequests, which can be changed at any time.

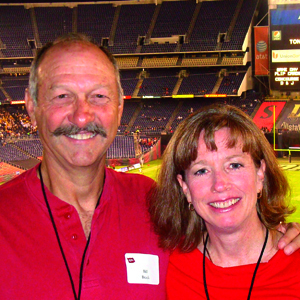

Bracks give back

Bill Brack, ’76, a finance major, and his wife, Karen, began exploring the idea of a planned gift to SDSU when they were updating their estate plans.

Karen is a loyal Louisiana State University alumna, and the couple has divided their giving between the two universities.

“We wanted to give back to our alma maters,” Bill said. “We both feel that our college education gave us the opportunity to have fulfilling careers, and we want to create the same educational opportunity for other deserving students.”

Leaving a legacy

What Jones likes to emphasize is that anyone can leave a legacy.

“By leaving a bequest or gift to SDSU through your estate plan,” she said, “you start a legacy and also send a message that you value education.”